Fed’s Rate Increase Seems Unlikely As Economy Remains Uncertain

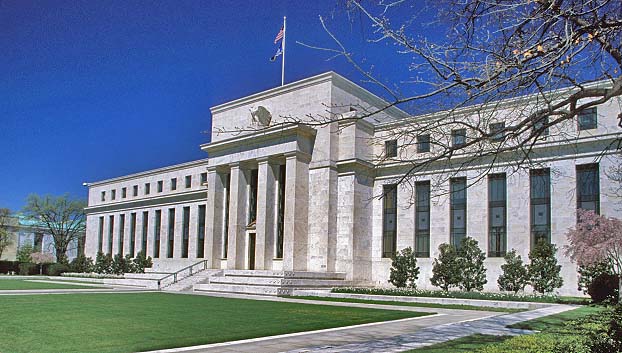

For six and a half years the Federal Reserve has held its key interest rate at nearly zero and for the whole time there has been speculations in the financial world about when the Fed will start to raise them. The view of most economists is that with low inflation and still a subpar economy the Fed will keep the rates at record lows until September at least. On Wednesday they may be clarifying their plans after having finished with their last policy meeting. Analysts advise caution and they say that no one should expect any specific guidance over the Fed’s rate increase.

There are still too many uncertainties that surround the United States economy. The policymakers of the Fed might want to leave space for maneuvering until it is in their opinion that the health of the economy has become stable. After the March meeting the Fed opened possibilities to a rate increase during this year when they said that they will no longer be patient in starting to raise their benchmark rate. Most economists have stated that dropping “patient” from the Fed’s statement could mean that they might raise rates as soon as June. This step could stabilize the economy’s course by slowing borrowing and squeezing bonds and stocks. However during a press conference the chair of Fed Janet Yellen stated that although Fed is planning an approach of rising rates, they have not yet decided when the best moment to do this will be. Yellen also added that whatever decision is made it will depend mainly on the current situation of the economy and the latest data. But the data has been disappointing in the last few months. Employers have only hired 126,000 workers last month which is the least since December 2013.

In light of the Fed’s meeting this week the government is planning on releasing the first estimate of growth for the years first quarter. It is expected that the number will fall under a modest 2.2% annual rate for October and December quarter. However economists predict a rebound in the current quarter and also during the rest of the year by around 3%. If these estimates are proven correct than we could expect Fed to start raising rates since 2006.